If you need cash fast, a payday loan might be your answer. But these loans come with hidden costs that can have long-lasting effects on your credit score. Here’s what you need to know before taking out a payday loan. When you need cash fast, a payday loan is an easy solution.

These short-term loans are expensive for the borrower and exorbitantly priced for the lender as well, which makes them a less-than-ideal solution for financial emergencies. However, if you’re desperate for some cash fast — and don’t want to borrow from a friend or family member — then a payday loan could be your answer.

How does a payday loan affect your credit score?

The interest rates on payday loans can be extremely high. Many of these loans have annual percentage rates (APRs) of more than 400%, which can significantly harm your credit score. These high rates of interest can also increase the cost of paying off the loan in the long run, so it’s important to keep paying on these loans until the entire balance is paid off.

Debt collectors: In the event that your payday lender decides to sell your loan to a debt collector, the collector is not obligated to keep the credit bureaus informed of your default.

Lawsuits: If you break the terms of your payday loan, your payday lender has the authority to sue you. Your credit score will be impacted if you go to court and lose (either because you were found guilty or didn’t show up), which will be reported to a credit bureau.

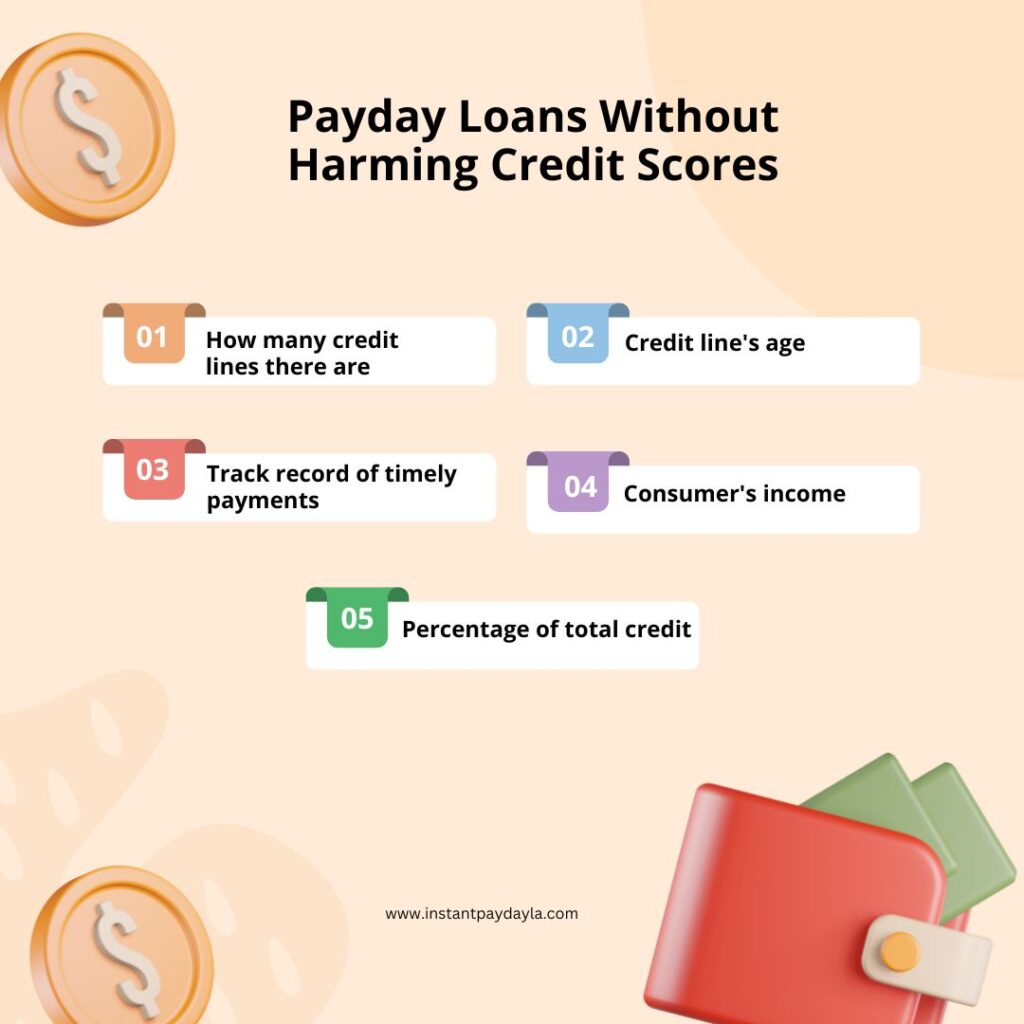

Using Payday Loans Without Harming Credit Scores

Although a payday loan will likely lower your credit score, it’s possible to have a payday loan without damaging your credit score. If you have a good payment history and a good payment history, then it’s possible to get a payday loan without lowering your credit score.

If you take out a small loan and pay it off right away, then you’ll have no negative impact on your credit score. Just remember that future loans taken out from this point on will cost you significantly more.

The simplest approach to prevent a payday loan from damaging your credit is to never take out a loan unless you are very positive you can repay it — and any associated charges or fees — on time and in full.

Contact the lender right away if something happens that prevents you from making the whole payment on time. For borrowers who experience difficulties during repayment, the majority of lenders have programs in place. They might be able to negotiate a different deal with you or prolong the payback time. Naturally, they’ll probably charge you a price for this privilege, so proceed with caution!

- How many credit lines there are

- Each credit line’s age

- Each credit line’s value

- The remaining amount of money borrowed from each credit line

- Percentage of total credit available that is being used

- Track record of timely payments

- Quantity of credit inquiries

- Consumer’s income

How Credit Scores are Calculated

The way in which your credit score is calculated will depend on the type of credit you have. Credit reports contain information about your credit score, including the amount you owe, your payment history, and how long it will take you to pay off the loan.

If you have a mortgage, your credit score will also take into account the amount of equity you hold in the property. Your credit score is calculated using a number of different factors to determine how likely it is that you will be able to repay your loan.

These factors include the amount you owe, how long it will take you to pay off the loan, and the amount you owe compared to the value of the property you own.

What Types of Loans Impact Your Credit Score?

Credit scores can be impacted by the following types of loans:

Home Equity Line of Credit (HELOC): HELOCs, also known as home equity loans, impact your credit score based on the amount you owe. The amount you owe is multiplied by the HELOC’s interest rate and added together with your payment history.

Mortgage: Your credit score is impacted by the amount you owe on your mortgage. If you have a high credit score and you owe a small amount, this will have a large impact on your credit score.

How to avoid credit damage from payday loans

If you need to take out a payday loans no credit check, do so only if you have an emergency situation in which you need money immediately. Payday loans should be used only as a last resort, and it’s important to remember that you’ll end up paying more in fees, interest, and damage to your credit score.

Tips to help build your credit score when taking out a loan

- Check your credit score regularly and keep a log of how long it takes you to pay off the loan.This will help you keep track of your progress and make sure that you’re on track to pay off the loan as quickly as possible.

- Always make your payments on time, and don’t let your loan balance build up.

- If you have to take out a large loan to pay off a previous loan, then you have to make payments on both loans.

- Avoid taking out any new loans while you have a loan to pay off. This will make it difficult to pay off the old loan and could damage your credit score.

- If your credit score is low, then try taking out a smaller loan and paying it off as quickly as possible. This will help build equity in your credit score.

Summing up

Payday loans can negatively impact your credit score and cost you a lot in fees over the long term. Payday loans are short-term loans that cost you a lot of money in fees, interest and damage to your credit score.

If you need cash fast, a payday loan is an easy solution. But these loans come with hidden costs that can have long-lasting effects on your credit score. The interest rates on payday loans can be extremely high, and many of these loans have an annual percentage rate (APRs) of more than 400%. These high rates of interest can also significantly harm your credit score. If you need cash fast, a payday loan might be your answer. However, these loans come with hidden costs that can have long-lasting effects o